PAGE 32

Many businesses may already offer benefits that meet or exceed federal standards, or can

meet the standards with minor adjustments. These companies may find they can capitalize on

going above and beyond to help protect workforce health and wellbeing.

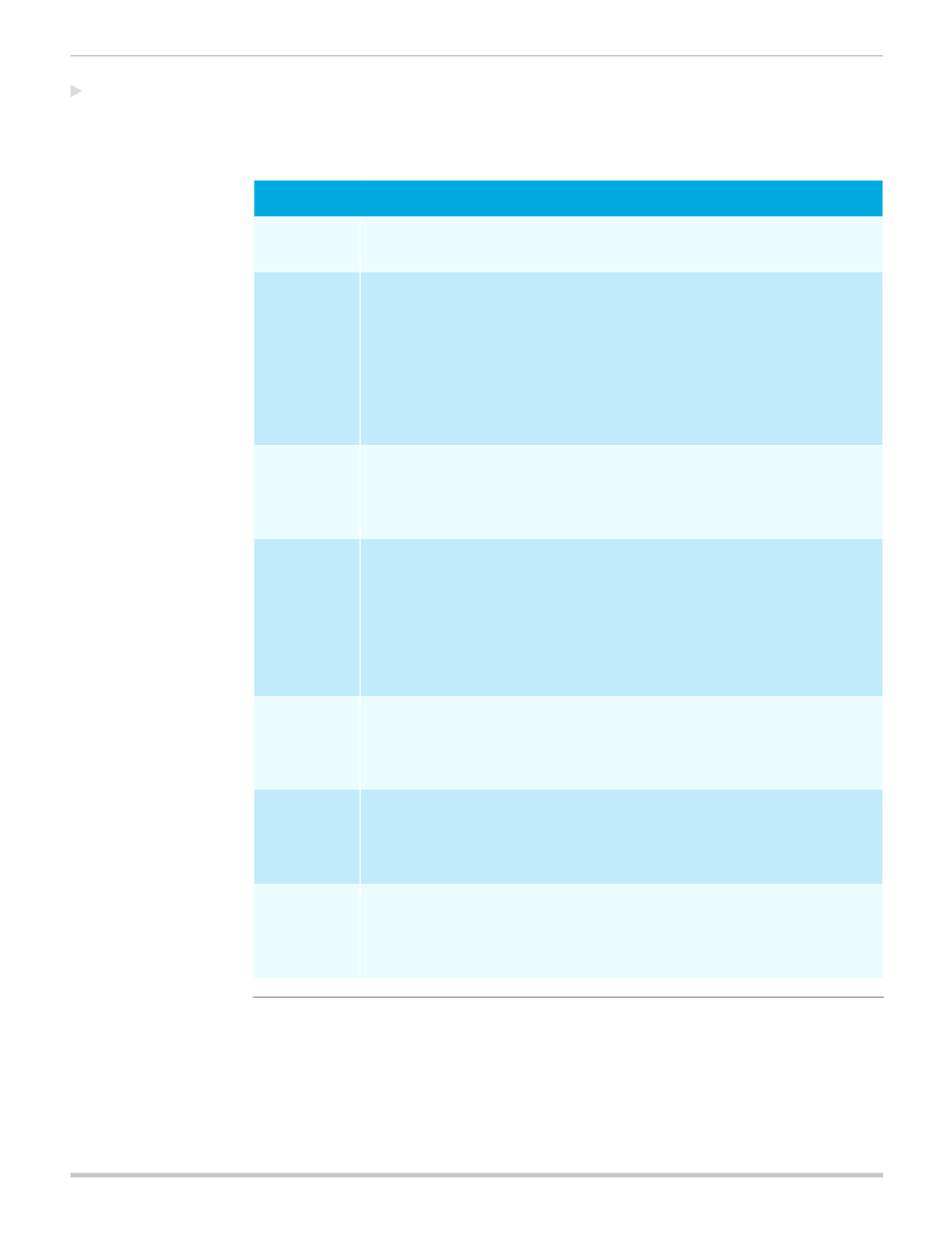

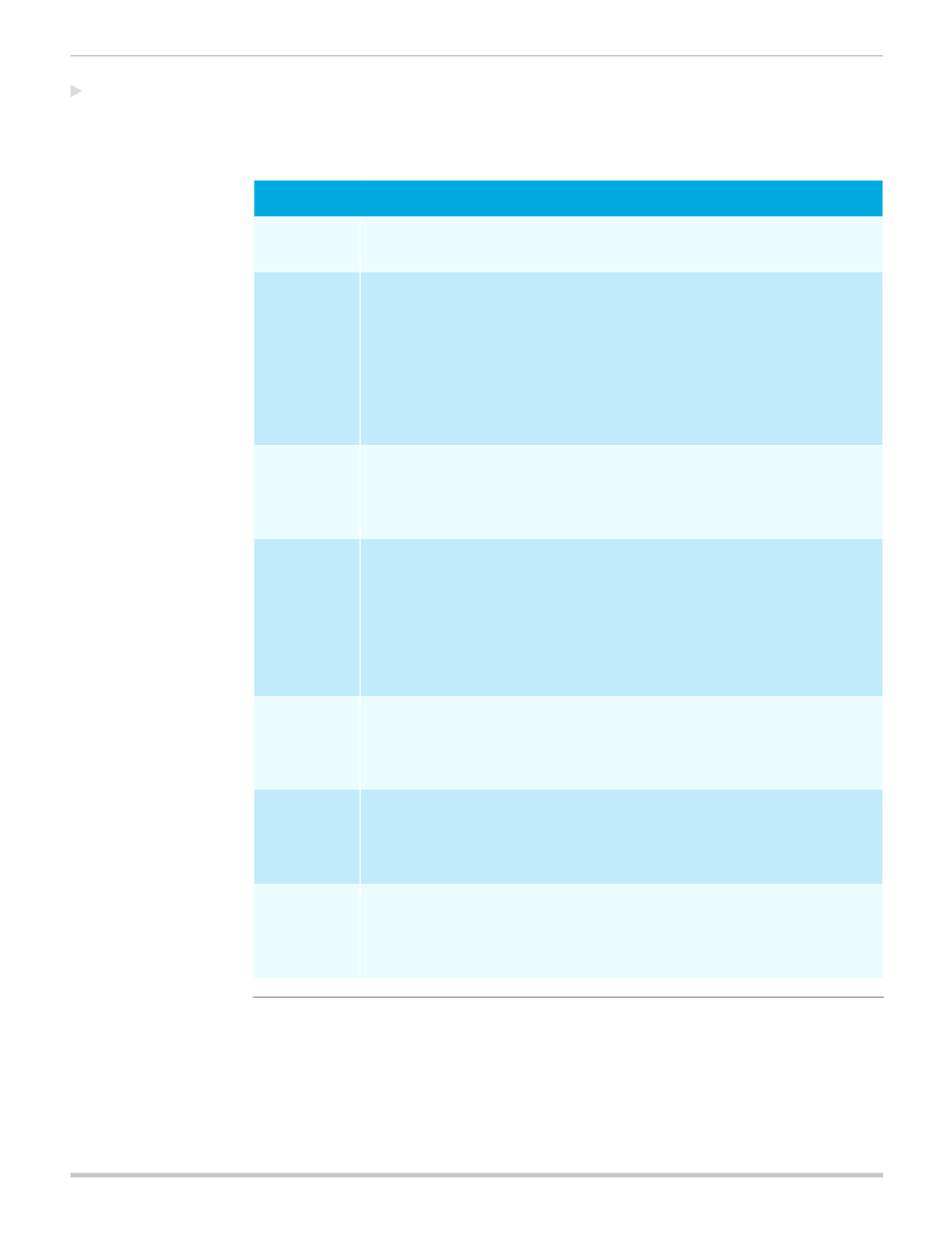

Considerations

Coverage

• The employer provides minimum value coverage that meets affordability

requirements.

Compliance

• The employer will need to comply with all applicable federal and state laws and rules.

• The employer will need to comply with the new Affordable Care Act (ACA) benefit

mandates including metal levels and/or minimum value requirements.

• The employer needs to be aware of all the ACA compliance requirements, specifically

the benefit mandates, and grandfathering if applicable, that directly affect them.

• Employers must notify employees regarding the availability of the Health Insurance

Marketplace and subsidies that could help lower the cost of insurance coverage (by

October 1, 2013, and for all new employees at the time of employment).

Tax Credits

• The employer will not be eligible to receive small business tax credits.

• Employees may be eligible to receive Health Insurance Marketplace subsidies if their

employer’s coverage does not provide minimum value or affordability requirements.

Penalties

• Starting in 2015, employers with 100 or more full-time equivalent employees may

be subject to shared responsibility penalties if coverage either does not meet

affordability or minimum value requirements, and is offered to fewer than 70 percent

of its full-time employees and the dependents of those employees (unless the

employer qualifies for 2015 dependent coverage transition relief).

• In 2016, the 70 percent threshold is increased to 95 percent and the shared

responsibility penalties will also apply to employers with 50 or more full-time

equivalent employees.

Administration • The employer will continue to use their current practices to work with issuers to

obtain and maintain coverage.

• Starting in 2016, the employer will submit required reporting to the Internal Revenue

Service.

Employee

Tools and

Resources

• Employees will use current practices for open enrollment and select from health plan

choices that are made available by the employer.

• Employees may use a single seamless process to obtain a full benefits package

including voluntary benefits.

Supplemental

Insurance

Protection

• The employer can provide voluntary benefits to workers along with the current health

plan.

• These policies can be bought separately to help employees cover out-of-pocket

costs associated with illness or injury.

Adjust

Current Plan