PAGE 25

The SHOP Marketplace is an online market where small businesses and their employees will

have access to private health insurance coverage. In most states, eligible businesses will need

to have 1-50 employees.* Employers with up to 100 employees can participate in the SHOP

Marketplace beginning in 2016. States may allow large employers in 2017.

* Although exchanges can be open to employers with up to 100 employees, federal and state exchanges can

keep the cap at 50 employees until 2016. The method of counting employees varies based on whether the SHOP

Marketplace is operated by a state or the federal government. If it is the state, state law rules apply. If federal,

counting includes full-time equivalent employees as under the shared-responsibility penalties.

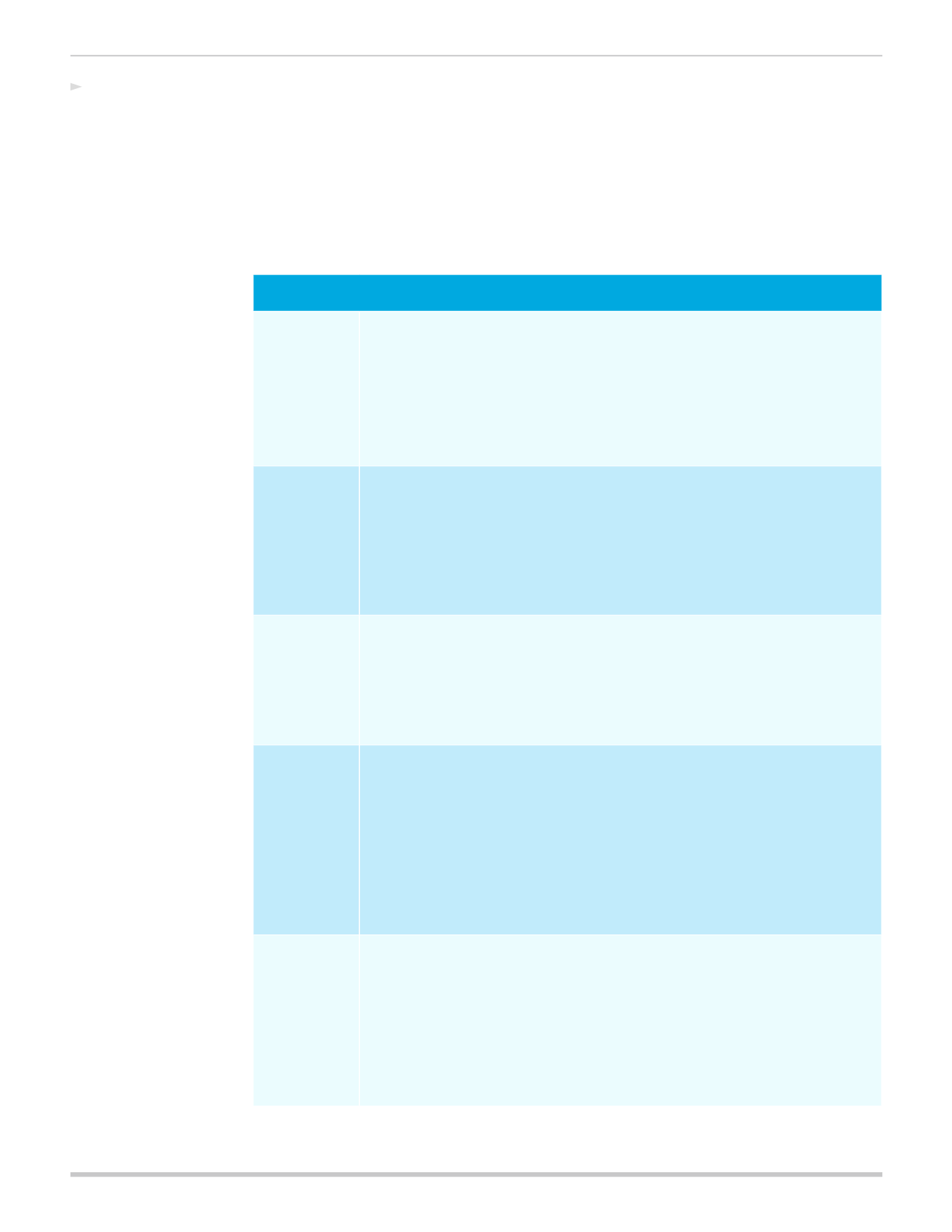

SHOP Marketplace

Coverage

• Starting in 2014, businesses have the option to choose a qualified health plan (QHP)

to offer to their workforce (employer choice).

• Beginning in 2015, an employer can choose the level of coverage to offer their

workforce, and employees will be able to select from multiple QHPs (employee

choice).

• QHPs will include essential health benefits and will meet actuarial value level

requirements.

Compliance

• Employers will need to comply with all applicable federal and state laws and rules,

including ACA provisions.

• Employers need to be aware of all the ACA compliance requirements, specifically the

benefit mandates, and grandfathering if applicable, that directly affect them.

• Employers must notify employees regarding the availability of the Health Insurance

Marketplace and subsidies that could help lower the cost of insurance coverage (by

October 1, 2013, and for all new employees at the time of employment).

Tax Credits

• A small employer may receive tax credits based on eligibility.

-- Employer must cover at least 50 percent of the cost of single (not family) health

care coverage for each employee.

-- Employer must have fewer than 25 full-time equivalent employees (FTEs).

-- Employees must have average annual wages of less than $50,000.

Administration • On October 1, 2013, open enrollment begins for small businesses with coverage

effective dates beginning 1/1/2014.

• Employers will need to submit an application online along with a list of eligible

employees, and use one of the other consumer assistance functions (call center,

agents, navigators, and in-person assistors) to check eligibility.

• In 2015, when employee choice is implemented, the SHOP will provide employers

with a single invoice and collect payments.

• Employers will need to perform payroll deductions, and work with SHOP to reconcile

enrollment information, billing and termination functions.

Employee

Tools and

Resources

• Employees will use SHOP consumer assistance during open enrollment.

• Employees will need to submit an application for enrollment and select the plan.

• If the employer selects Employee Choice (available in 2015), the employees will need

to use appropriate decision support tools and select the plan that best fits their

needs.

• Employees may be required to use the SHOP for all updates, special enrollments,

terminations and other applicable functions.

Small Business

Health Options

Program (SHOP)

Marketplace

continued on next page