PAGE 5

actuarial value of 70 percent, on average, the covered individual is responsible for 30 percent

of the costs of all covered benefits. The covered individual could be responsible for a higher or

lower percentage of the total costs of covered services for the year, depending on the actual

health care needs and the terms of the insurance policy.

Applies to: Insurance carriers offering insurance coverage to small usinesses. Does not apply

to grandfathered plans.

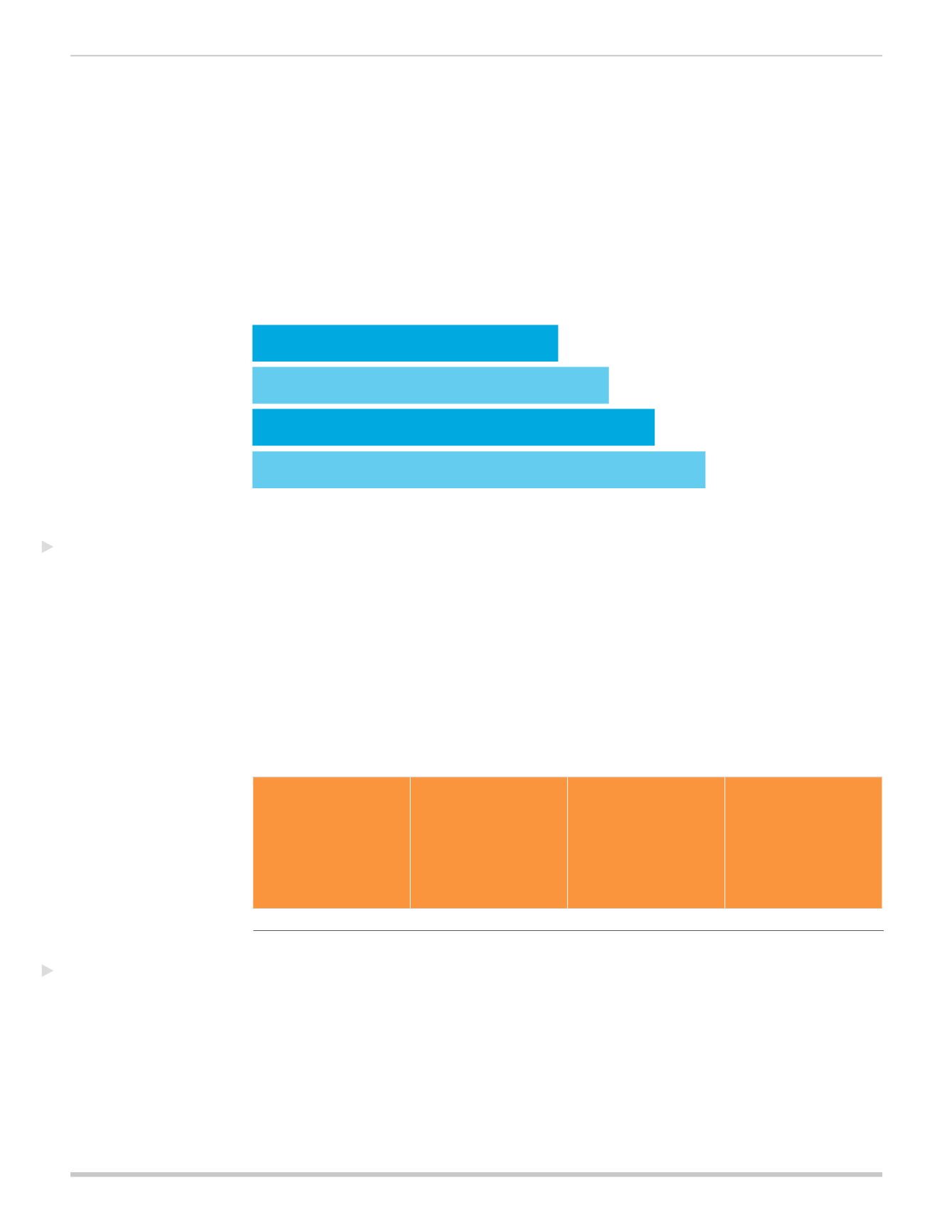

Affordable

Minimum

Value

Coverage

Figure 2:

Affordable Minimum Value Coverage

Large Employers (with at least 50 employees)

Health plans cover

at least 60% of the

total allowed cost

of benefits using

the minimum value

definitions.

Employee

contribution does

not exceed 9.5%

of the employee’s

W-2 income.

Self-funded plans

and fully insured

plans not required

to cover Essential

Health Benefits

(EHB).

If EHB are included,

no dollar limits

on lifetime or

annual benefits

are allowed.

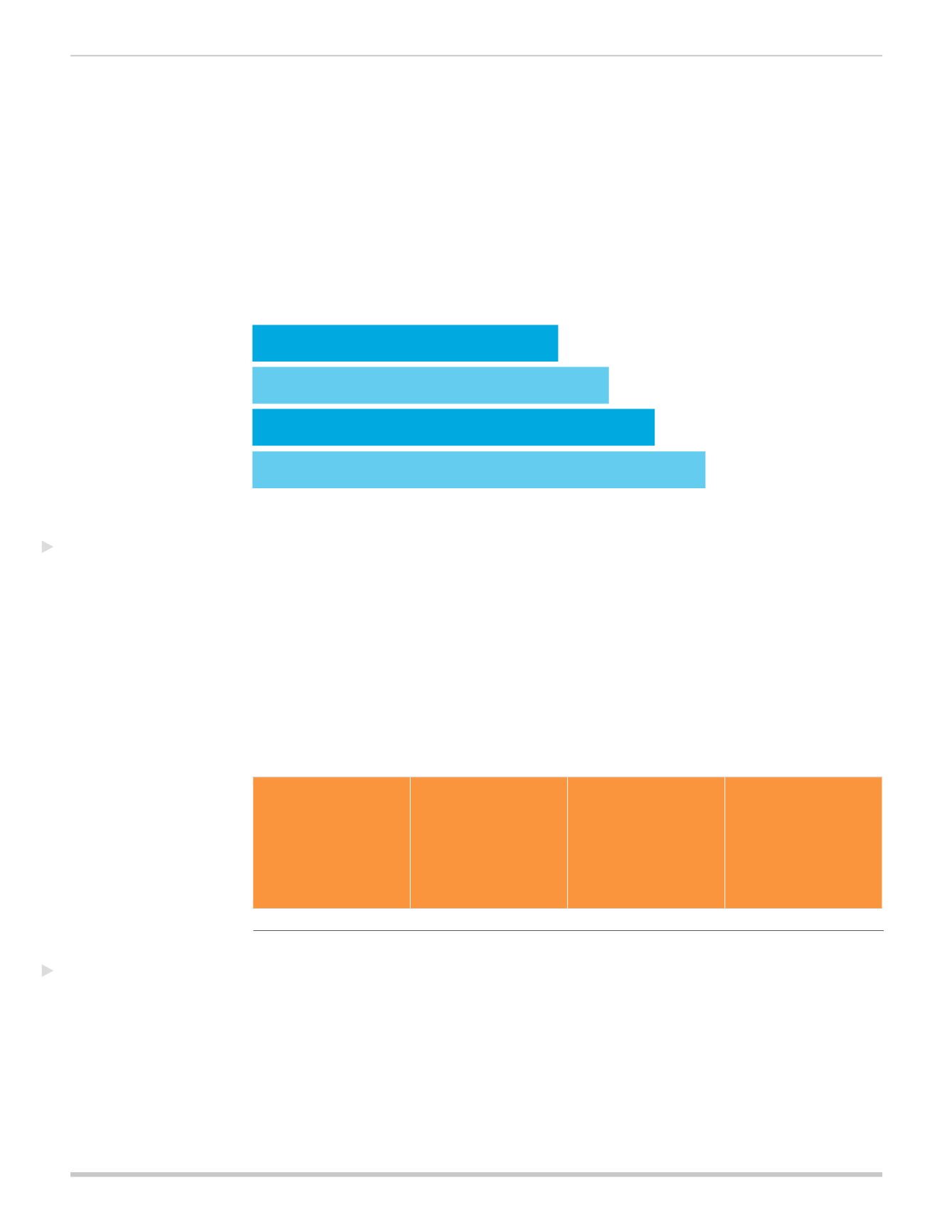

Figure 1:

Actuarial Value Standards

Small Employers ( ≤ 50 employees or ≤ 100 employees, depending on the state)

Bronze

60%

Silver

70%

Gold

80%

Platinum

90%

Note: The definition of actuarial value may vary by 2 percent.

Affordable, minimum value coverage means that health plans must generally cover at least 60

percent of the total allowed cost of benefits using the actuarial value definitions. Additionally, a

plan is considered affordable if the employee portion of the premium for self-only coverage is

less than 9.5 percent of the employee’s W-2 income. Large employers must meet affordable

minimum essential coverage requirements, or may be subject to a penalty.

Applies to: Large businesses (with 50 or more full-time employees or their equivalencies).

HIPAA excepted benefits are not subject to market reform changes of the ACA, and are

available to employers of all sizes, as well as individuals. These include: supplemental

indemnity coverage, hospital indemnity coverage, critical illness coverage, accident insurance,

vision and dental insurance, as well as wellness programs and value-added services.

Health Insurance

Portability and

Accountability

Act (HIPAA)

Excepted Benefits