PAGE 12

Requirements include:

1

| Coverage must be purchased through the SHOP Marketplace

2

| Employer must cover at least 50 percent of the cost of single (not family) health care

coverage for each employee

3

| Employer must have 25 or fewer full-time equivalent employees (FTEs)

4

| Employees must have average annual wages of less than $50,000

Note: Small, tax-exempt employers such as charities may be eligible to an increase from 25 percent to 35 percent. As

of 8/26/13,

states that businesses with

fewer than

25 employees are eligible for these credits, however Internal

Revenue Code Section 45R states that the term “eligible small employer” means an employer which has

no more

than

25 full-time equivalent employees for the taxable year. For more information about these credits, visit:

Individual Mandate

In 2014, individuals must obtain minimum essential coverage or pay

a penalty. The annual tax penalty is the greater of designated amounts based on year

(see figure 5). Individuals may be exempt from the mandate for any of the following reasons:

• Where the consumer contribution exceeds 8 percent of household income

(indexed after 2014)

• Coverage gap is less than three months

• Hardship situations as determined by the Department of Health and Human Services

• Religious exemptions

• Members of Indian tribes

• Not lawfully present in the United States

• Living abroad

• Incomes below tax filing threshold

• Incarcerated

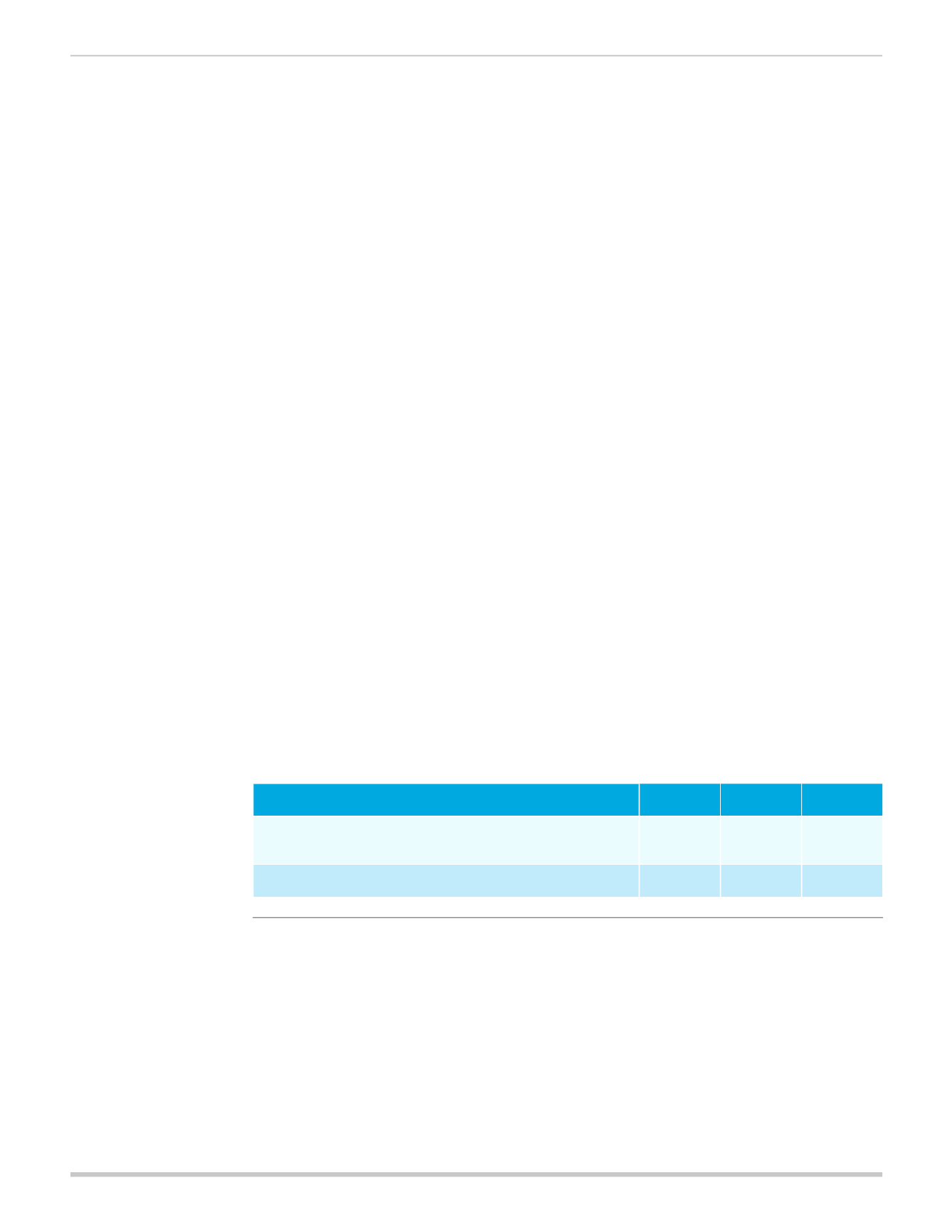

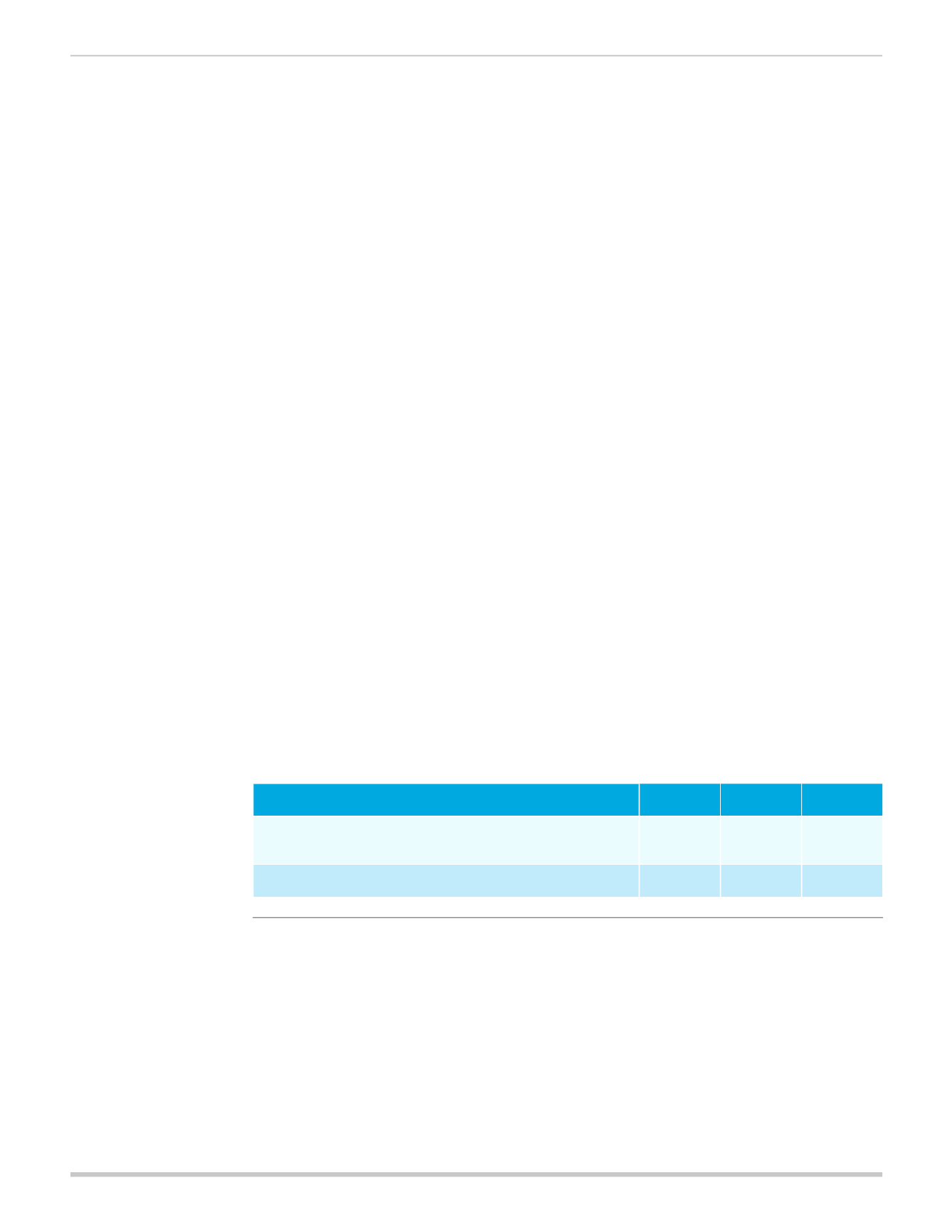

Figure 5:

Penalty Type

2014

2015

2016+

Flat dollar amount (total capped at 300%

of the per person adult amount)

$95

$325

$695

Percentage of taxable household income

1.0% 2.0% 2.5%

Health Insurance Marketplace and Subsidies

Effective 2014, individuals will have the opportunity to participate in the Health Insurance

Marketplace. Advance Premium Tax Credits (APTC) are available through the Health Insurance

Marketplace. APTCs are available to households with incomes between 100 and 400 percent

of the FPL and who do not have access to affordable, minimum value employer coverage.

Credits are based on the second-to-lowest-cost “silver” plan (70 percent actuarial value).

There are also cost-share reductions available for households with incomes between 100 and

250 percent FPL, which lower the out-of-pocket expenses for low-income consumers when

they select the silver plan.