PAGE 9

W-2 Reporting

To help show how much health care coverage costs, employers who file 250 or more W-2s

are required to report the total aggregate cost of major medical health benefits and certain

pre-tax funded supplemental health coverage provided to each employee on their 2012 W-2

forms. This information must be reported in Box 12, using Code DD. The reporting is for

informational purposes only and has no tax impact to the employer.

Note: Reporting is optional for employers who file fewer than 250 W-2s until further guidance is issued by the IRS.

Flexible Spending Account (FSA) Limits

For cafeteria plan years beginning on and after January 1, 2013, employer-sponsored

cafeteria plans must limit employee annual salary reduction contributions to health FSAs

to $2,500. The $2,500 limit applies to employee participants on a plan-year basis, and will

be indexed for cost-of-living adjustments for future plan years.

Note: The limit does not apply to certain employer non-elective health FSA contributions, or to any contributions or

amounts available for reimbursement under other types of FSAs (such as a dependent care FSA), health savings

accounts (HSAs), health reimbursement arrangements (HRAs), or to salary reduction contributions to cafeteria plans

used to pay an employee’s share of health coverage premiums.

Patient-Centered Outcomes Research Institute (PCORI) fee:

Starting with plan years ending on or after October 1, 2012, issuers and plan sponsors are

required to pay a new fee for each covered beneficiary with the fee going to the PCORI fund.

The fee is treated as an excise tax and is filed through IRS Form 720. The PCORI fee is $1 per

covered beneficiary for the first year, and for the first year was due July 31, 2013.

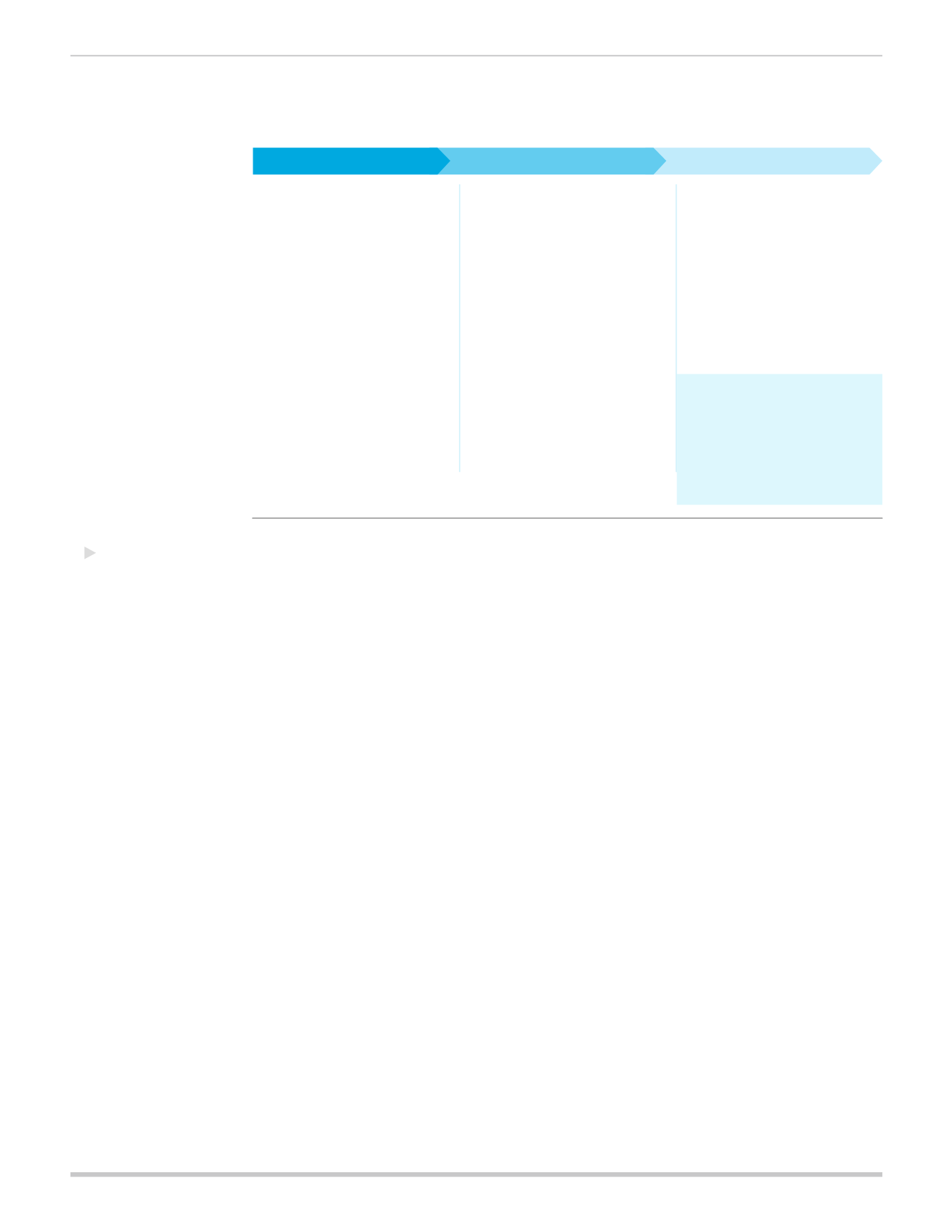

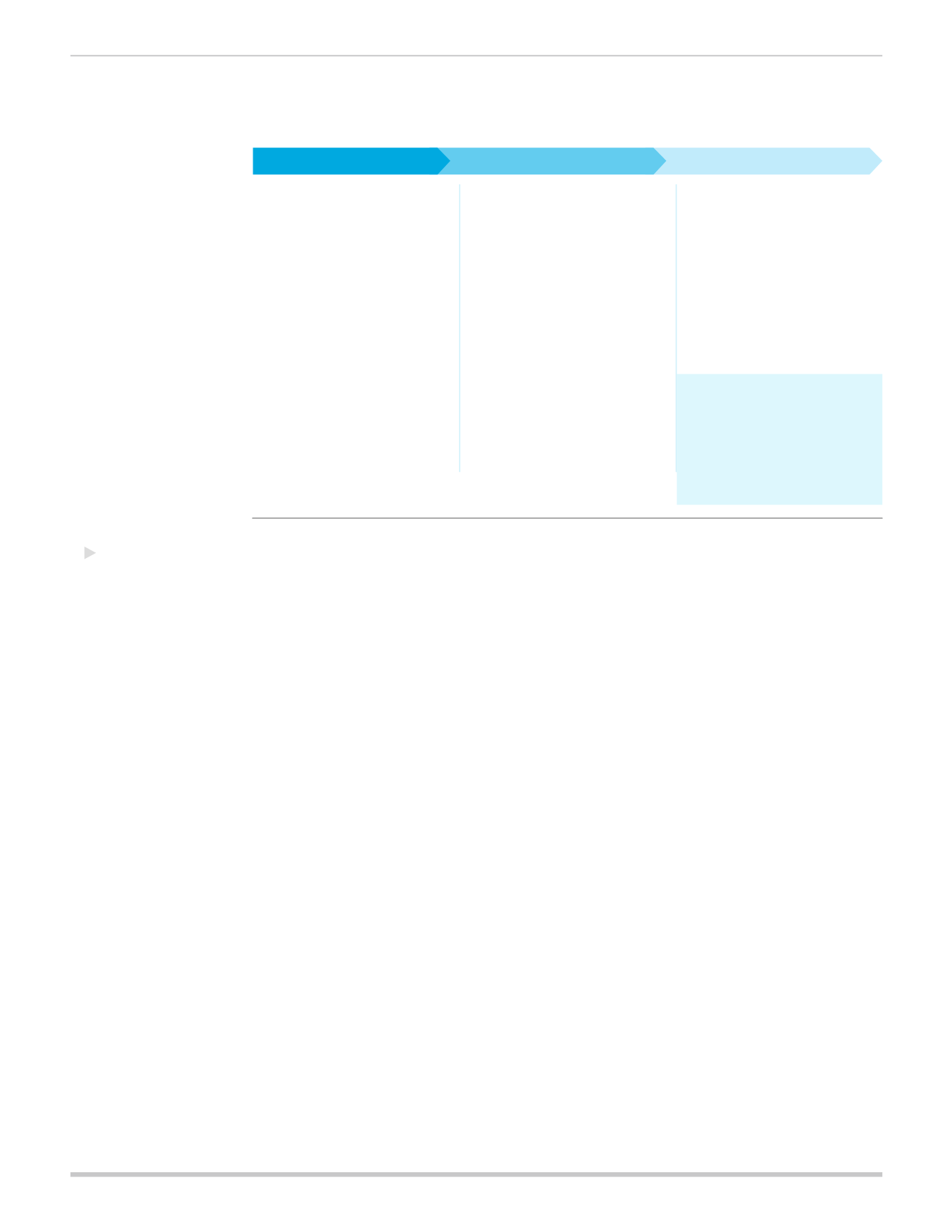

2013:

Preparing

for Reform

Figure 4:

Implementation timeline at-a-glance

• W-2 Reporting

• FSA Limits

• PCORI Fee (July 31)

• Medicare Tax Changes

• Medicare Part D Subsidy

Deduction Eliminated

• Notice of the Health Insurance

Marketplace (October 1)

• Health Insurance Marketplace

Open Enrollment (October 1)

• Market Reform

• Out-of-pocket Limits

• Waiting Periods

• Individual Mandate

• SHOP and Small Group

Tax Credits

• Health Insurance Marketplace

and Subsidies

• Medicaid Expansion

• Taxes and Fees

• Risk Programs

• Minimum Essential Coverage

(MEC) Reporting (2016, for

calendar year 2015)

• Employer Shared Responsibility

Payment

• Large Employer Size Change

(2016)

• Large Employers and the Health

Insurance Marketplace (2017)

• Cadillac Tax (2018)

Delayed or pending

guidance:

• Auto-Enrollment.

• Non-discrimination Testing

for full-insured

• Quality Reporting

Provisions begin on January 1st unless otherwise noted.

2013

2014

2015-2018