PAGE 13

Taxes and Fees

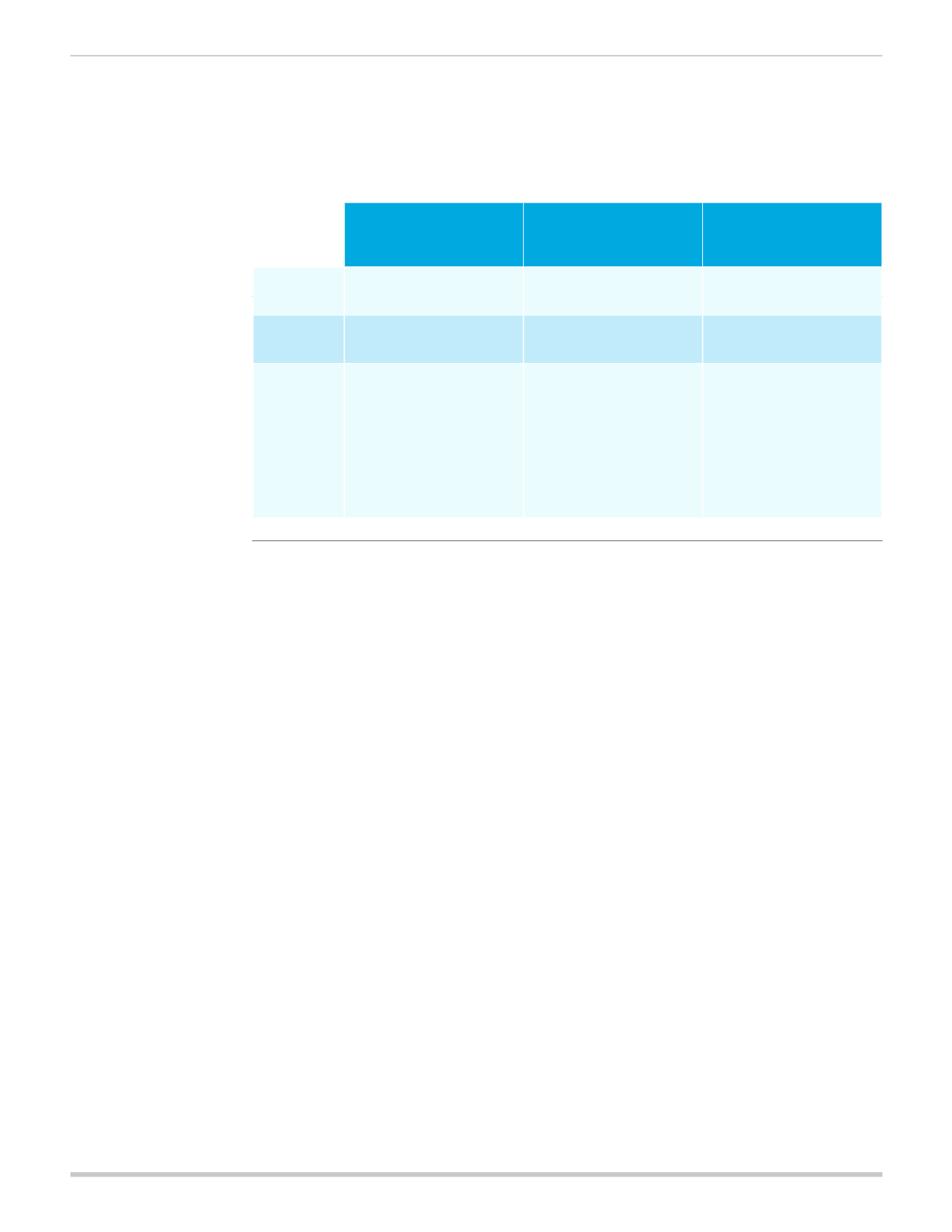

Starting in 2014, there will be three major tax/fee provisions that may impact employers (see

figure 6).

Elimination of Mini-Meds and Limited Benefit Plans

In the past, employers with large, part-time or low-wage workforces and high turnover

provided mini-med and limited benefit plans as an alternative to major medical insurance.

However, due to significant benefits design changes, such as essential health benefits, metal

levels and prohibition of annual dollar limits, these plans will be eliminated. Effective January 1,

2014 annual dollar limits on essential health benefits are not permitted in any market.

Waiting Period Limits

The ACA restricts waiting periods to a maximum of 90 days, beginning January 1, 2014.

Out-of-Pocket and Deductible Limits

Health care reform requires out-of-pocket and deductible maximums to align with the annual

HSA limits effective 2014. The deductible limit only applies to individual and small employer

insured plans, but does not apply to grandfathered plans. The out of pocket limit applies to all

non-grandfathered plans for fully insured and self-insured employers. Out-of-pocket costs or

annual cost-sharing includes deductibles, copays, coinsurance and similar charges, as well

as any other payment toward medical expenses that is considered an essential health benefit,

but does not include balance billing.

Note: The limit on out-of-pocket maximums will be the same as the out-of-pocket maximum for HSA compatible high-

deductible plans in 2014, but will be subject to inflation adjustment in 2015 and beyond. For 2014, the out-of-pocket

maximum was $6,350 for single coverage and $12,700 for family coverage. The maximum deductible limit in 2014 will

be $2,000 for single coverage and $4,000 for other tiers. These limits will also be subject to adjustment for inflation in

2015 and beyond. The out of pocket and deductible limits do not apply to grandfathered plans.

Figure 6:

Health Insurer

Tax

Patient Centered

Outcomes Research

Fee

Reinsurance Fee

Who is

impacted?

Fully Insured

(Paid by Insurers)

Fully Insured and

Self Insured

Fully Insured and

Self Insured

When?

Beginning 2014

Beginning October 2, 2011,

ends in 2019

2014-2016

How much? *Estimated premium

impacts 1.9% -2.3%

increase in 2014, rises to

2.8% -3.7%

by 2023

Annual fee on $1 per

enrollee for plan years

ending after October 1,

2012 and before October 1,

2013, then $2 per enrollee

until 2019 (indexed after

2014)

For 2014, the fee for each

plan is $63 per enrollee per

year. Premiums increase

in employer segments.

Premiums decrease in

individual market, since the

program pays reinsurance

for high risk individuals