PAGE 15

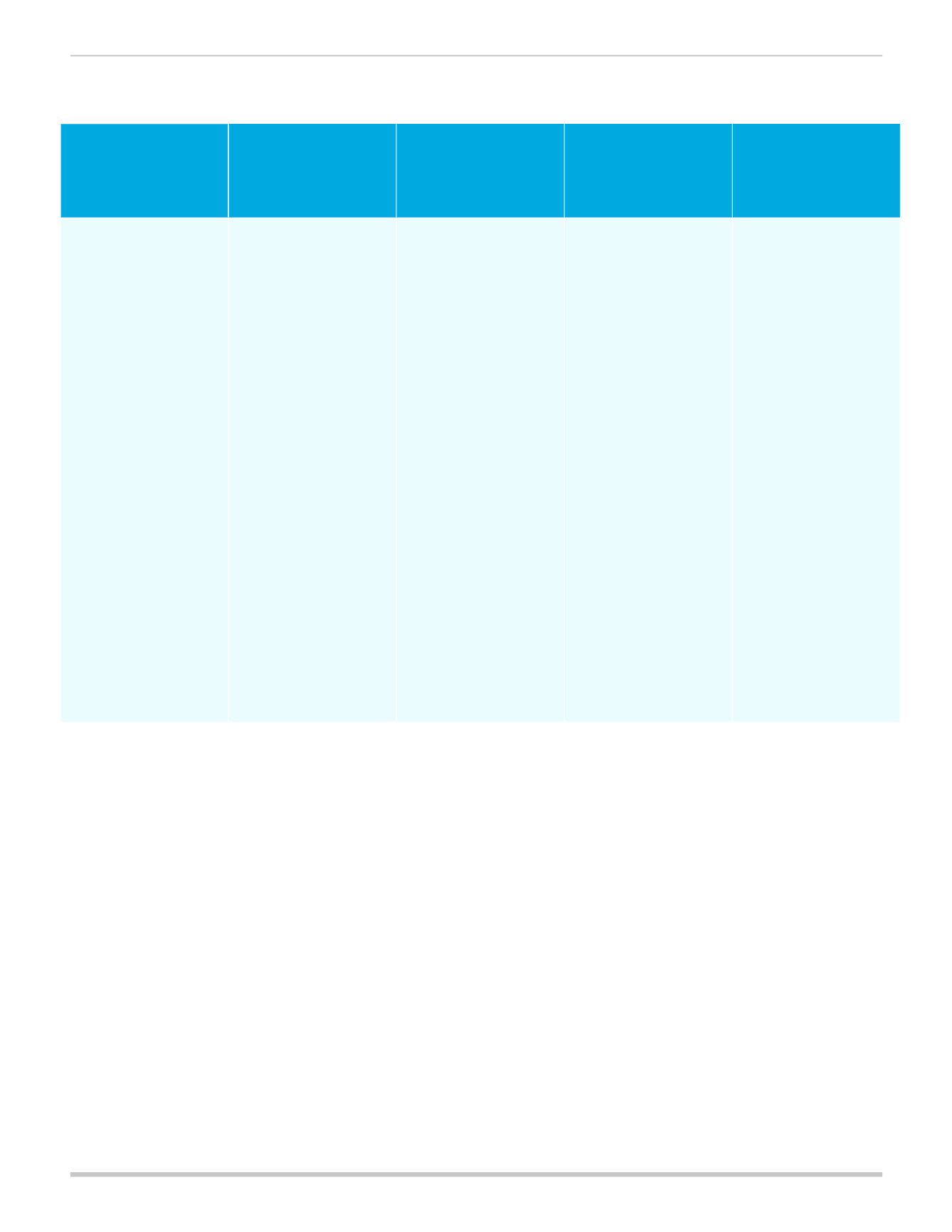

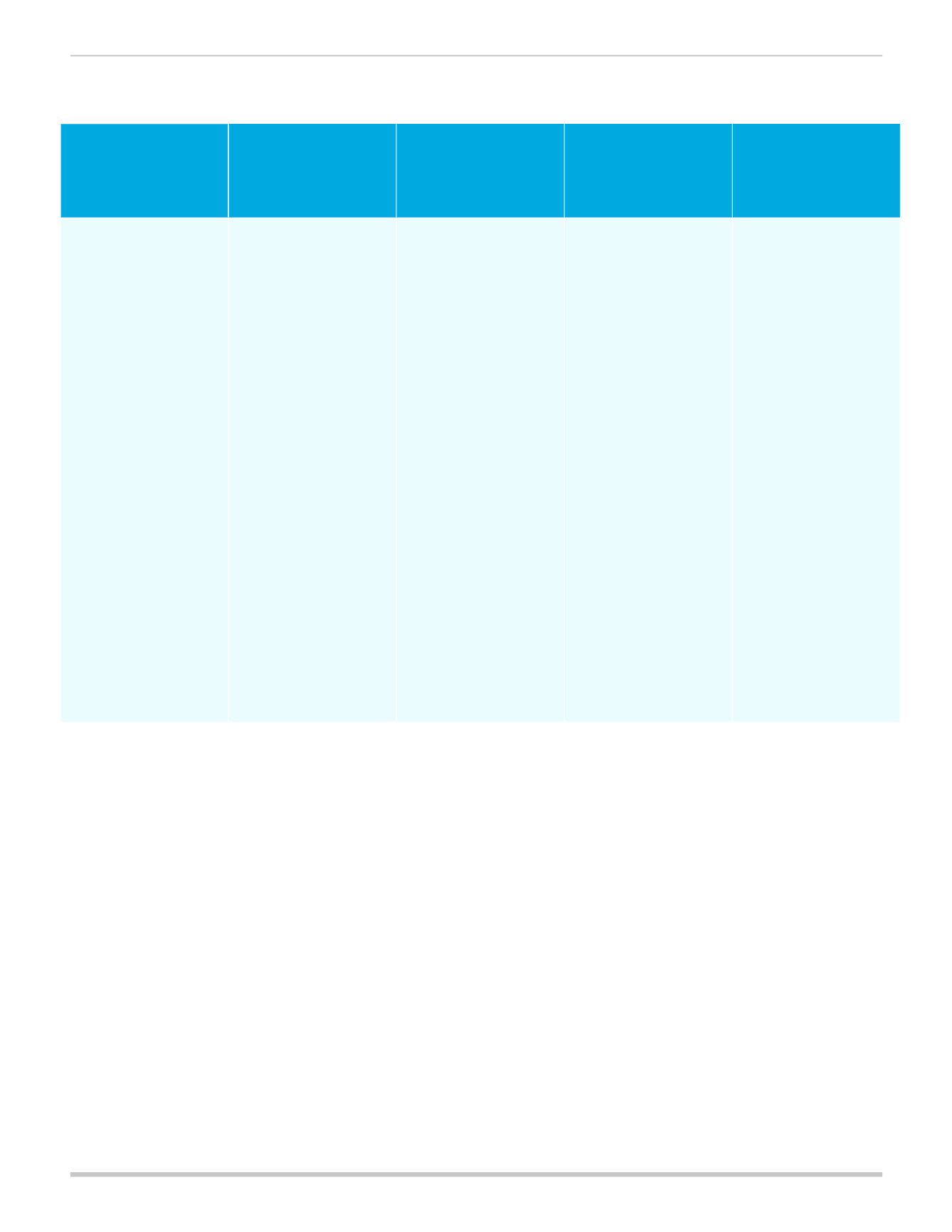

Figure 7:

What defines a small employer?

Note: The ACA and the IRS use different calculations for determining the number of employees. Employers may simultaneously qualify as a small employer

under ACA, but be considered a large employer for IRS purposes. In addition, each state may use different counting rules for the purposes of pre-reform rating

and rate reviews.

SHOP Participation

Outside the Health Care

Reform Marketplaces

Exception to

Employer Shared

Responsibility/Pay or

Play Requirement

Small Employer Tax

Credit

Exception to W-2

Reporting

• Small employer

definition is 1-100, but

states can use 1-50

until 2016. Almost all

states currently use

1-50. If the Federal

government is running

the SHOP Marketplace,

the state definition (50

or 100) applies.

• If a state is running

the SHOP, the state

law rules for counting

employees apply. For

example, states might

not count part-time

employees.

• If the federal

government is running

the SHOP Marketplace,

federal rules apply that

count the sum of total

full-time employees

(30+ hours per

week) and full-time

equivalents. This is the

same rule that the IRS

uses for the employer

responsibility payment.

• Small employer

definition is 1-100, but

states can use 1-50

until 2016. Almost all

states currently use

1-50.

• The ACA counts

the average of the

total number of all

employees employed

on business days

during the preceding

calendar year. Each

employee W-2 is

considered one

employee including

part-time employees.

• Applies for ACA reform

provisions, such as

benefit mandates.

• State law rules may

also apply.

• Small employer

definition is 1-49.

• Counts the sum of total

full-time employees

(30+ hours per

week) and full-time

equivalents. This is the

same rule that will be

used in federally run

SHOP Marketplaces.

• Small employer

definition is 1-25.*

Average annual wages

must be less than

$50,000.

• Count all hours worked

for each employee (up

to 2,080 hours per

employee) and divide

by 2,080.

* Note: As of 8/26/13,

states that fewer

than 25 employees

are eligible for these

credits, however

Internal Revenue Code

Section 45R states that

the term “eligible small

employer” means an

employer which has no

more than 25 full-time

equivalent employees

for the taxable year. For

more information about

these credits, visit:

• Less than 250 W-2s in

the preceding year.