PAGE 19

and even one full-time employee receives a premium tax credit through the public Health

Insurance Marketplace, then the penalty is equal to $2,000 multiplied by the number of

full-time employees. A different, generally lesser penalty applies when an employer offers

minimum essential coverage, but the coverage does not meet minimum value requirements

or is considered unaffordable. In this case, the employer will have to pay $3,000 for each

employee who purchases subsidized coverage. With the $3,000 penalty, the employer has

offered coverage, but the coverage does not satisfy the minimum value and affordability tests.

The total amount of the $3,000 penalty cannot be greater than the total penalty for failing to

offer any coverage.

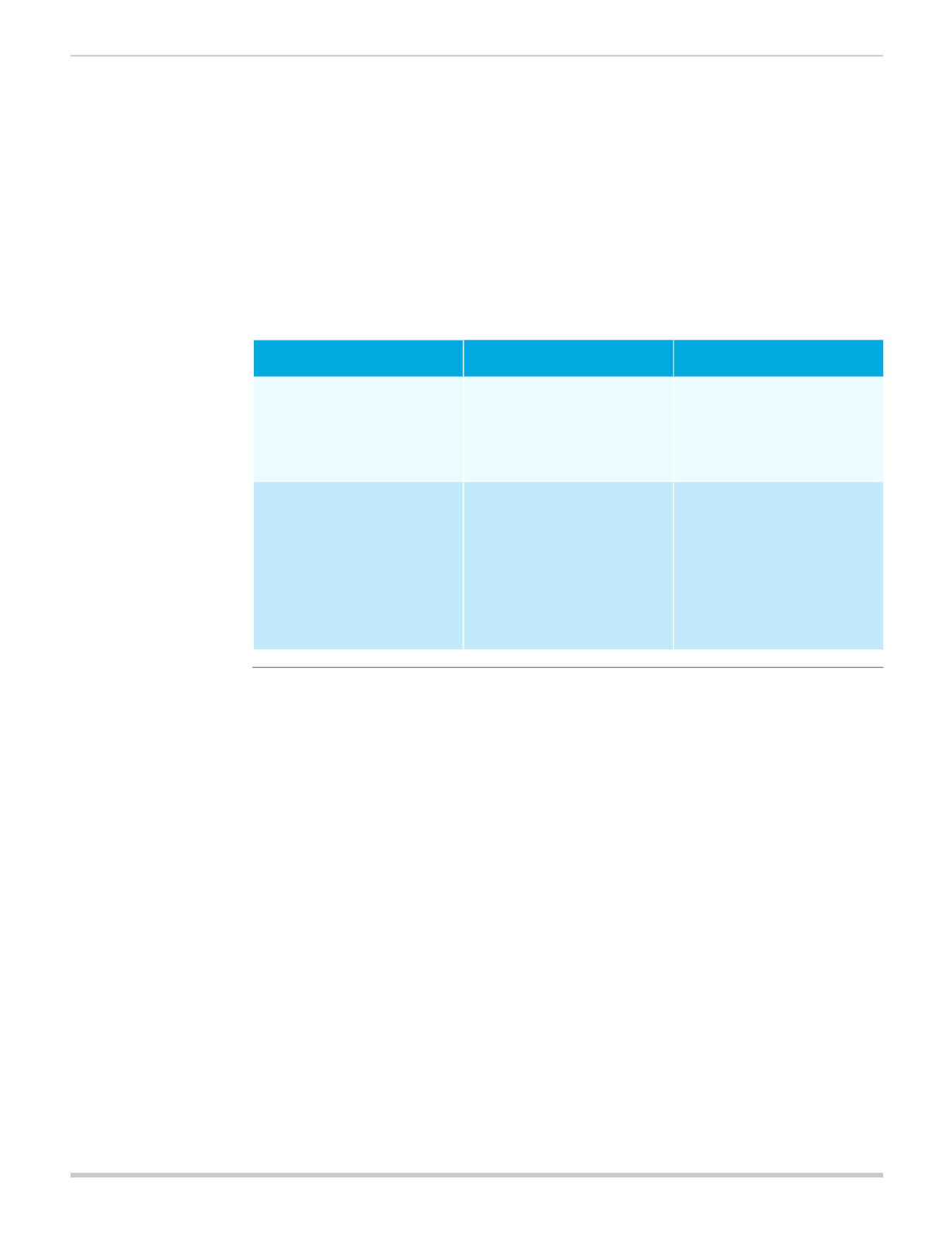

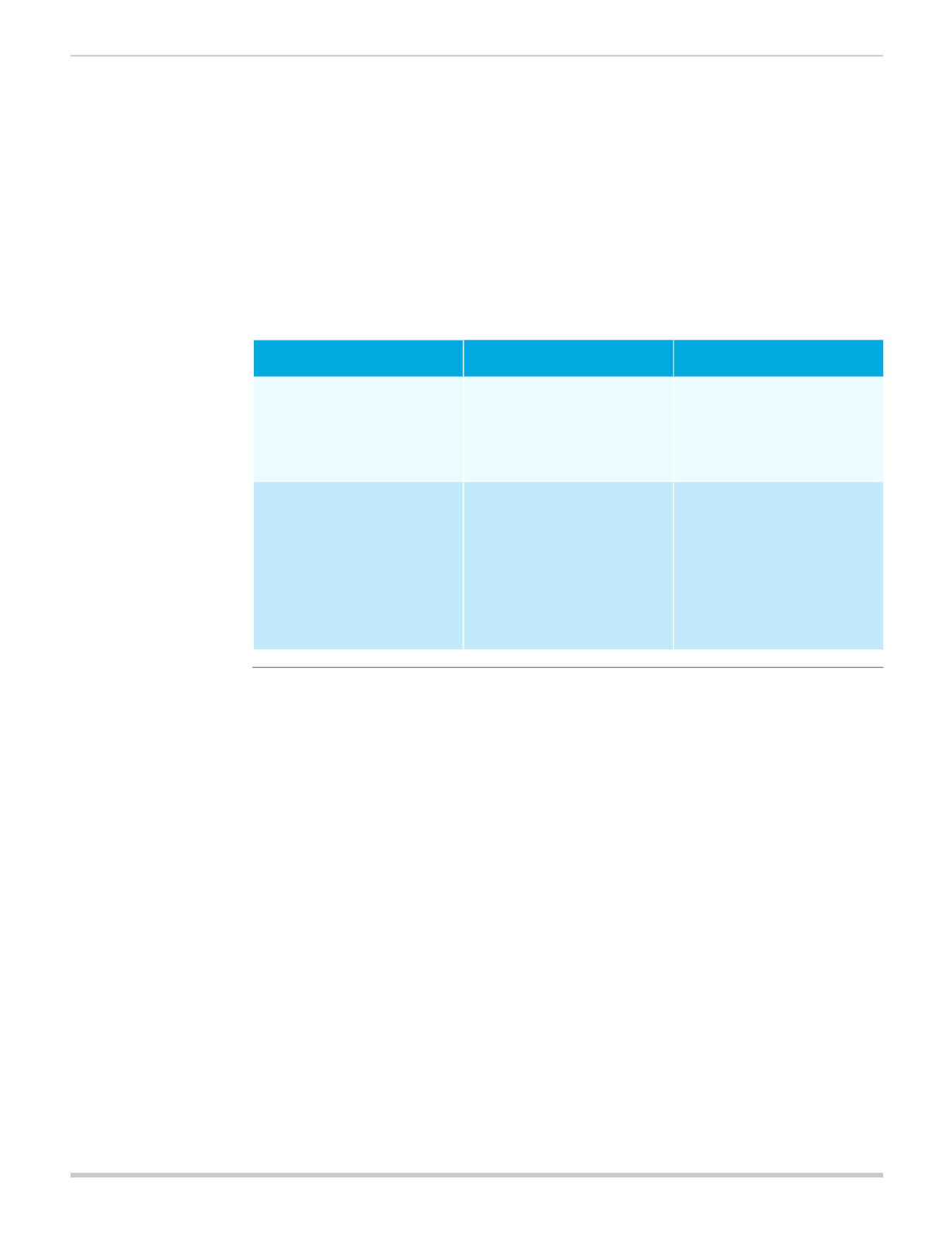

Figure 9:

Scenario

Calculation

Example

Employer fails to offer

minimum essential coverage

to substantially all full-time

employees and their dependents

$2,000 X (Total number of

full-time employees - first 30

employees)

Employer with 51 full-time

employees:

$2,000 X (51-30) = $42,000

Penalty is: $42,000

Employer offers minimum

essential coverage that is either

unaffordable or does not satisfy

minimum value requirements.

Lesser of (a) and (b)

(a) $2,000 X (Total number of

full-time employees - first 30

employees)

(b) $3,000 X (The number of

full-time employees receiving

a subsidy)

Employer with 51 full-time

employees and 10 full-time

employees obtain tax credits:

(a) $2,000 X (51-30) = $42,000

(b) $3,000 X 10 = $30,000

Penalty is: $30,000

Dependent Coverage and Cost

The employer shared responsibility payment provision does not include a requirement to cover

spouses. However, employers are required to make coverage available to dependents up

to 26 years of age or face a penalty. In 2013, health care costs are expected to increase

per employee by 5.3 percent (0.6 percent lower than in 2012). The average expected un-

subsidized costs of individual coverage is projected at $11,607 ($8,911 employer share, and

$2,696 employee share).

3

Minimum Value and Actuarial Value

Actuarial value is relevant under health care reform for a number of purposes. The minimum

value standard under the employer shared-responsibility requirement requires that the plan

pay at least 60 percent of covered expenses. If a small employer purchases group health

insurance (either through the SHOP Marketplace or through a private marketplace), health

care reform requires that the plan have a minimum actuarial value of at least 60 percent (they

may also have an actuarial value of 70, 80, or 90 percent).

Currently, the employer market offers an average of 83 percent actuarial value,

4

but often

employees are not aware of the actuarial value of their health care coverage or their