PAGE 21

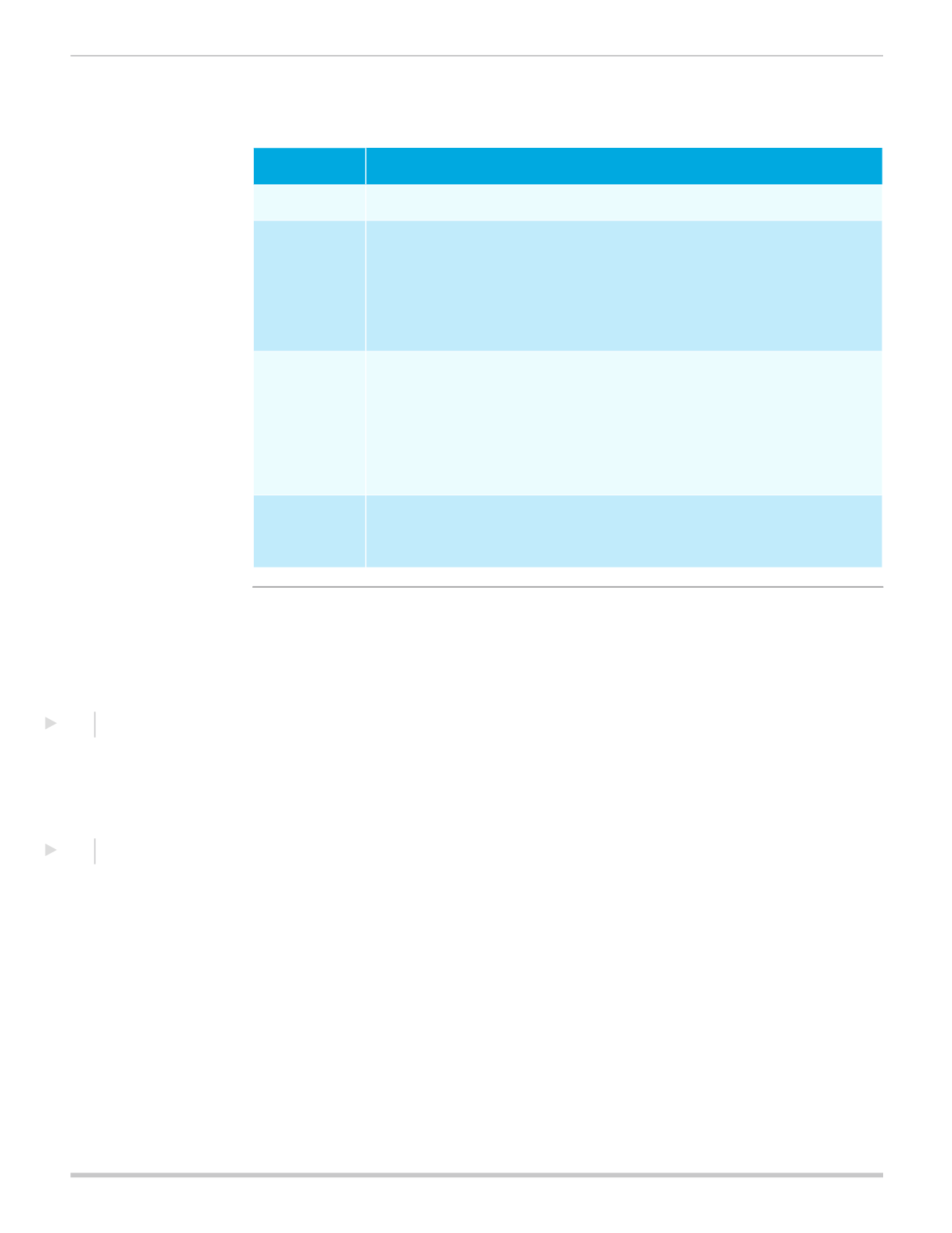

Figure 10:

Considerations by Business Size

Employer Size

≤

25 FTEs

May be eligible for Small Employer Tax Credits

1-50

• Considered small employer

• Eligible to participate in SHOP

• No shared responsibility payment if less than 50 FTEs

• Benefit plans must comply with Essential Health Benefits requirements

and Actuarial Value/Metal level requirements

51-100

• Considered small employer beginning 1/1/2016 (or earlier at state option)

• Eligible to participate in SHOP beginning 1/1/2016 (or earlier at state option)

• Benefit plans must comply with Essential Health Benefits requirements and Actuarial

Value/Metal level requirements beginning 1/1/2016 (or earlier at state option)

• Beginning Jan 1, 2016, the shared responsibility payment applies if the size is at least

50 FTEs

100+

• May be eligible to participate in SHOP beginning 1/1/2017

• Beginning in 2015, the shared responsibility payment applies if the size is at least

100 FTEs

For the first time, employees who do not have access to employer-sponsored coverage will

have available health insurance options in the new market, regardless of their health status or

pre-existing conditions.

Small Business Tax Credits

Small employers purchasing employee benefits through the SHOP Marketplace may receive

tax credits for up to 50 percent of the cost of providing employer-sponsored health coverage

These tax credits may offer a cost-effective way to boost total workforce compensation.

Advance Premium Tax Credits (APTC)

Employees with household incomes between 100 percent and 400 percent of the federal

poverty level (FPL) may be eligible for tax credits through the Health Insurance Marketplace,

making coverage cheaper through the Health Insurance Marketplace rather than their

employer. However, employer-sponsored insurance (ESI) affects employee eligibility for

available tax credits, and could determine whether employees will receive credits, as well as

whether their employer is penalized. The table below shows employees’ eligibility for subsidies

based on the available ESI coverage.

4

Federal

Premium Tax

Credits

3

Guaranteed

Issue in the

Individual Market